Research and Development (R&D) tax credits are a powerful tool to incentivize innovation and support businesses in pursuing technological advancements. While R&D tax credits are available across various sectors, some industries are particularly well-positioned to benefit from these incentives. This article will explore the top industries that can leverage R&D tax credits to drive innovation, fuel growth, and gain a competitive edge.

Technology and Software Development

The technology industry is synonymous with innovation, making it a prime candidate for R&D tax credits. Companies engaged in software development, artificial intelligence, machine learning, data analytics, and cybersecurity often invest substantial resources into R&D activities. From developing groundbreaking algorithms to enhancing user interfaces, these endeavors can qualify for R&D tax credits, providing significant financial relief and encouraging continuous innovation.

Pharmaceutical and Biotechnology

The pharmaceutical and biotechnology sectors are at the forefront of groundbreaking discoveries and medical advancements. Researching and developing new drugs, treatments, medical devices, and diagnostic tools often involve extensive experimentation, clinical trials, and scientific breakthroughs. R&D tax credits play a vital role in supporting these industries, as they incentivize investments in research that can lead to life-saving innovations and improved patient care.

Aerospace and Defense

The aerospace and defense industries rely heavily on R&D to push the boundaries of engineering, propulsion systems, materials, and aviation technologies. From developing advanced aircraft and spacecraft to enhancing military defense systems, companies in these sectors are constantly pushing the envelope. R&D tax credits provide crucial support, allowing organizations to invest in cutting-edge research, drive technological advancements, and maintain a competitive edge in global markets.

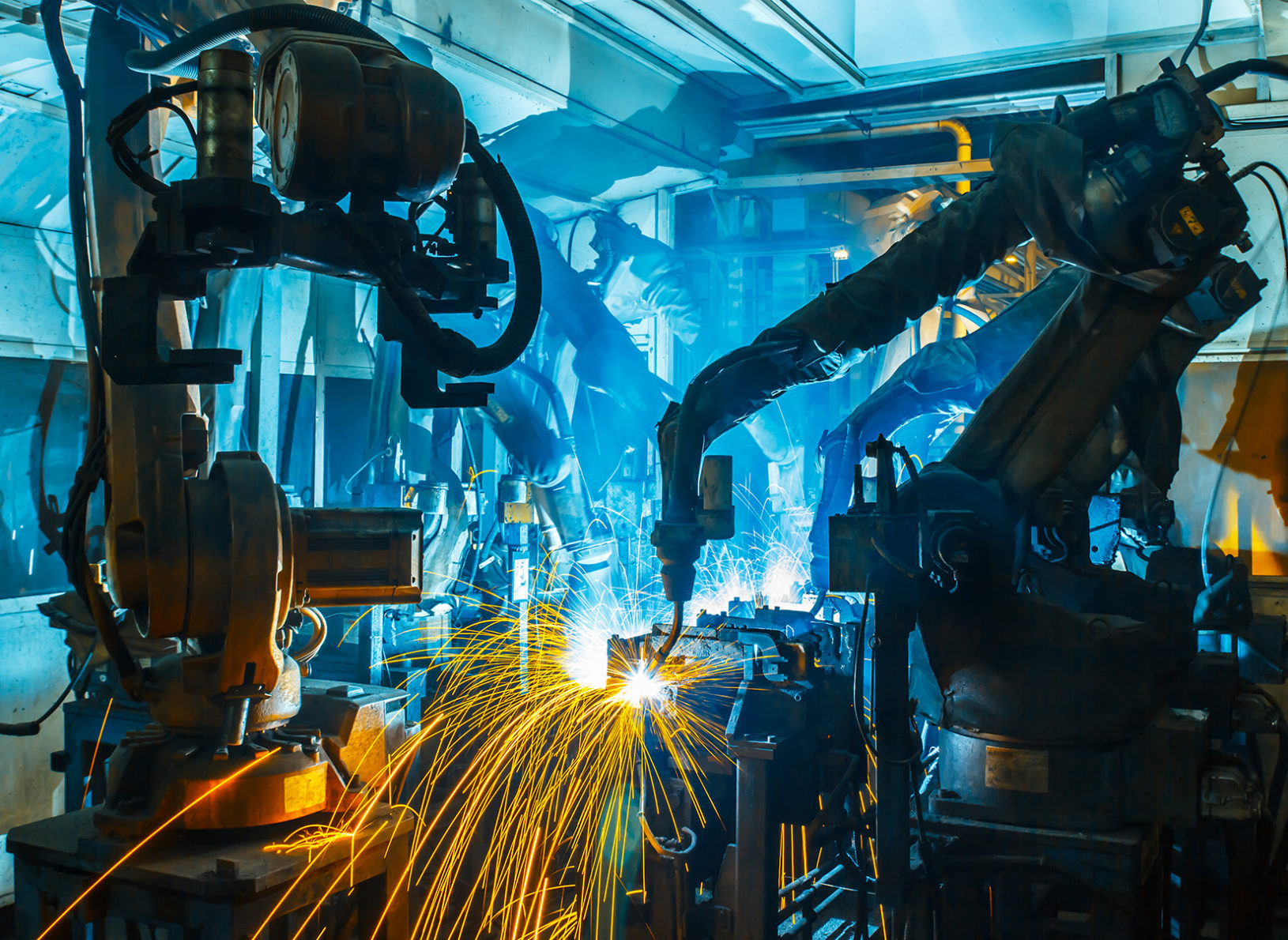

Manufacturing and Engineering

Manufacturing and engineering companies across various sub-sectors, such as automotive, industrial equipment, electronics, and advanced manufacturing, can benefit significantly from R&D tax credits. These industries are constantly striving to optimize processes, improve product designs, enhance energy efficiency, and develop new materials. R&D tax credits incentivize investment in innovation, enabling businesses to stay ahead of the curve and develop competitive products that meet evolving market demands.

Renewable Energy and Clean Technologies

The renewable energy and clean technology industries are experiencing rapid growth with an increasing focus on sustainability and environmental responsibility. Research and development efforts within these sectors involve improving renewable energy generation technologies, energy storage solutions, smart grid systems, and other clean technologies. R&D tax credits offer crucial financial support to companies engaged in these areas, fostering innovation, and accelerating the transition to a greener future.

Automotive and Mobility

The automotive industry is undergoing a significant transformation, driven by technological advancements such as electric vehicles, autonomous driving systems, and connectivity solutions. R&D tax credits provide automotive manufacturers and mobility companies with the means to invest in research and development, allowing them to develop cutting-edge technologies, enhance vehicle safety, improve energy efficiency, and shape the future of transportation.

Breweries and Distilleries

The brewing and distilling industry may not be the first sector that comes to mind when discussing R&D tax credits, but it is an industry that can indeed benefit from these incentives. Craft breweries and distilleries are constantly experimenting with new ingredients, flavors, brewing techniques, and fermentation processes. They invest significant resources in R&D activities to create unique and innovative products that cater to evolving consumer tastes. R&D tax credits can provide financial relief to these businesses, enabling them to continue their research efforts, refine their recipes, and develop distinctive beverages that stand out in a competitive market.

Conclusion:

R&D tax credits are a valuable resource for businesses across a wide range of industries, providing financial incentives and support for innovation-driven activities. The industries mentioned above are particularly well-suited to leverage R&D tax credits. By taking advantage of these incentives, companies can accelerate their research efforts, drive innovation, and gain a competitive edge in their respective markets. To explore the specific eligibility criteria and requirements for R&D tax credits in your jurisdiction, consult with tax professionals like KPT Consulting that are familiar with the local regulations and guidelines.